Monarch’s Film and Entertainment division, Monarch Film Credits, has placed over 1.2 billion of film, television, and digital media tax credits since 2006, and its division head, Marco Cordova, is one of the leading film tax credit experts in the nation, working for a Major Motion Picture Studio and another large entertainment company prior to joining Monarch. We help Major Studios and Independent Productions place film tax credits generated in U.S. jurisdictions offering transferable tax credits. We work with tax credit buyers wanting freely transferable tax credits in states with film tax credits such as Georgia, Massachusetts, California, Illinois, Connecticut, Pennsylvania, Nevada, New Jersey, Rhode Island, and Montana.

We assist Fortune 500 companies, private companies, and high net worth taxpayers who are all eligible to use film tax credits to offset their state tax liabilities. We have a large and experienced team of CPAs, tax attorneys, and accountants to help ensure our tax credit placement transactions are processed timely and accurately.

Our goal is to provide best in class service and value for tax credit consumers and production clients, which support local communities and economies through film, digital, and television projects.

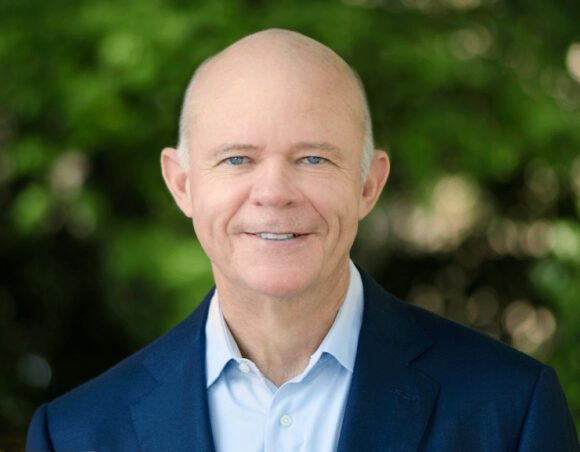

Marco Cordova, Director of Film Finance & West Coast Tax Credit Investments

Making a Difference

We help producers monetize their film and television tax credits, which creates thousands of jobs annually in filming jurisdictions that offer transferable tax credits. The productions also support many local businesses, including hospitality, restaurants and caterers, retail, and other service companies in filming locations.

For example, with our home office in Atlanta, we have been very supportive of the Georgia entertainment industry and are a leading tax credit broker in the state. The Georgia film tax credit program has generated more than $4 billion tax credits since the program’s inception. In fiscal 2019, Georgia film and TV spending reached $2.9 billion for the year. According to the Motion Picture Association of America, the Georgia film and TV industry created more than 92,000 jobs as of mid-2018, representing nearly $4.6 billion in wages.

Our Approach

Monarch Film Credits provides best in class customer service. We will respond to all requests within one business day, and we have tax credit experts that can help you navigate the tax credit placement process from start to finish.

Background

About State Film Tax Credits

Many states offer film & entertainment tax credits to encourage production, expenditure and job-creation within their states. For example, in 2005, Georgia approved the Film Tax Credit to generate revenue and entice film producers to come to the state. In 2008, Georgia passed O.C.G.A. §48-7-40.26 to further entice film production for the purpose of creating jobs and increasing expenditures in the state. The production company can sell the credits to raise capital to offset expenses of the production and ultimately lower their budget. Taxpayers in Georgia can benefit by buying the credits at a discount.

Benefits

Taxpayers will pay for a tax credit and receive anywhere from a 5% to 15% discount on the value of the film tax credit, depending on the state, tax year, amount, and seller profile.

For example, the taxpayer has a $25,000 Georgia tax liability and enters into a tax credit transfer agreement for $25,000 of 2019 Georgia film tax credits from a Major Studio. The taxpayer agrees to pay 88 cents per dollar of tax credit. So the taxpayer will owe $22,000 ($25,000 x $0.88). The taxpayer will save $3,000 ($25,000 – $22,000) on this transaction less any capital gains taxes owed.