We will keep you informed on what’s happening at Monarch.

Monarch’s Analysis of Energy Credits After Senate & House Passage of Big Beautiful Bill

Jul 3, 2025

The now “fully” passed bill heads to the President’s desk for signature (anticipated July 4, 2025). While not an ideal outcome, we are pleased that Monarch’s persistent direct advocacy resulted […]

Be Open About Business: Interview with George Strobel, Co-Founder and Co-CEO of Monarch Private Capital

Jun 17, 2025

Interview by Adam Mendler Monarch Private Capital is proud to share that our Co-Founder and Co-CEO, George Strobel, was recently featured in an in-depth interview conducted by Adam Mendler, a […]

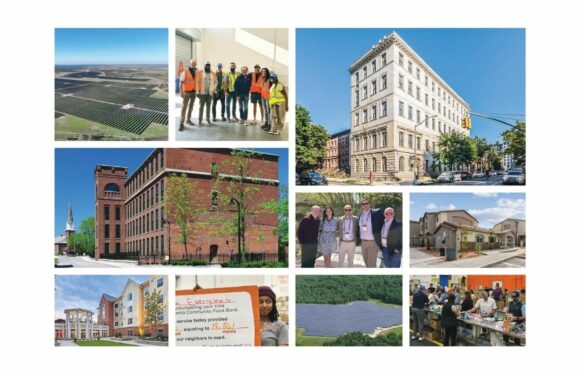

Monarch Private Capital Releases 2024 Impact Report: “Touchpoints”

Jun 16, 2025

Highlighting Scaled Impact, Strategic Innovation & Community Revitalization ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, finances, and manages a diversified portfolio […]

Monarch Private Capital Welcomes Michael Powley to Lead Data Innovation Across the Firm

May 29, 2025

Strategic hire underscores Monarch’s commitment to cutting-edge technology, data governance, and cross-functional excellence ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, finances, […]

HR 1 Undermines U.S. National Security and Traditional Republican Energy Policy

May 27, 2025

By George L. Strobel II In an age defined by technological competition, particularly in artificial intelligence (AI), the United States cannot afford to neglect the foundational pillars of national power: […]

Misinformation Rampant About Cause of Spanish GRID Blackout: Cause is Now Known

May 26, 2025

By George L. Strobel II In the wake of last month’s massive blackout that disrupted power across Spain, Portugal, and parts of southern France for more than twelve hours, speculation […]

TIME: The Clean Energy Tax Debate Will Shape America’s Economic Future

May 16, 2025

by Justin Worland As Republicans look to broker a sweeping budget deal, top GOP leadership in the House of Representatives unveiled a series of cuts this week to the provisions […]

Monarch Private Capital Wins Capital Finance International Award for Excellence in Tax Equity Impact Investing USA 2025

May 1, 2025

ATLANTA, May 1, 2025 (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch) is proud to announce it has received the 2025 Award for Excellence in Tax Equity Impact Investing USA from […]

A Strategic Imperative: Why Policymakers Must Secure America’s Solar Industry to Safeguard National Security

Apr 25, 2025

By George L. Strobel II As the U.S. prepares for the energy challenges of the coming decade, federal leadership has a unique opportunity—and responsibility—to ensure national security through strategic investment […]