What is Impact Investing?

Impact investing is investing for positive social and environmental impact while securing desired returns. At Monarch Private Capital, we carefully choose tax equity investments that align with our investors’ values and have a measurable positive impact on the environment and society. This way, investors can create meaningful change while earning financial rewards, leaving a positive mark on the world.

How Monarch’s Investing is Different

Unlike traditional funds, our funds are direct investments in projects that impact communities by creating clean power, jobs and homes while providing predictable returns through the generation of federal and state tax credits.

Impact Calculator

Want to see the impact of your socially responsible investment? Select an investment type and enter your dollar amount and we’ll quantify it for you.

Our Funds Invest In

Affordable

Housing

Developments that create jobs, build quality homes for seniors and families and generate state tax credits

Renewable

Energy

Projects that reduce CO2 emissions, create jobs, satisfy your sustainability goals and generate federal tax credits

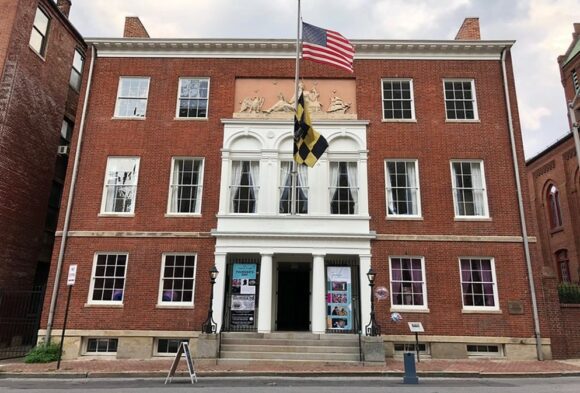

Historic

Rehabilitation

Restoration of historically significant buildings that create jobs, utilize sustainable construction materials and generate federal and state tax credits

Since 2005, Monarch Private Capital has managed tax equity impact investments more than 800 projects generating more than $5 billion of tax credits. Those projects have enabled over $13 billion in project capital and $33 billion in economic impact in 41 states, plus D.C.

800+

Total Projects

$5B+

Tax Credits

$13B

Project Capital

$33B+

Economic Impact

Featured Projects Glover Creek Solar

Glover Creek, a transformative solar project near Bowling Green, Kentucky, fills the void left by dwindling fossil-fuel-related jobs. Recognized as the second solar initiative approved by the state’s Electric Generation […]

View Project

Featured Projects The Peale

Located in Baltimore, Maryland, The Peale is an innovative, award-winning museum that amplifies and presents the voices and stories of Baltimore’s diverse communities, helping preserve the whole story of the […]

View Project

Featured Projects Badger State Lofts

The Badger State Lofts are located in Sheboygan, Wisconsin, on the rehabilitated site once home to the historic Badger State Tanning Company. The $30 million mixed-use residential community will soon […]

View ProjectSearch Our Map

Explore our map of some of our projects. Collectively, Monarch has managed tax equity investments in…

800+ projects in 41 states, plus D.C.

373 Affordable Housing

291 Renewable Energy

169 Historic Rehabilitation