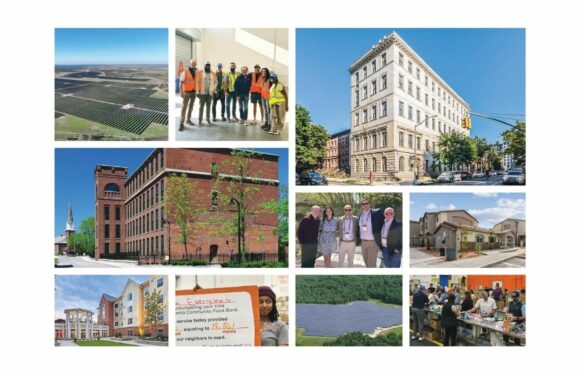

Monarch Private Capital has generated a positive impact on the environment and surrounding communities. Monarch’s management of tax equity for affordable housing has resulted in the development of 40,000 homes and the creation of more than 100,000 jobs. Our investment in the rehabilitation of over 150 historic buildings has benefited more than 20 states and numerous communities by infusing approximately 40,000 jobs and $2.3 of GDP into the U.S. economy. For the last eight years, Monarch has been actively involved in the development, ownership, management, and financing of 275 renewable energy projects across the country. These projects have generated more than GW of new renewable energy, reduced CO2 emissions by approximately 70 million metric tons, and helped investors to reach carbon neutrality while satisfying their sustainability initiatives.

Our Impact Objectives

Monarch assesses the environmental impact, social influence, and governance characteristics of each project and investment fund. Monarch’s tax-advantaged offerings include Environmental, Social, and/or Governance (ESG) characteristics. Our goal is to formalize our own impact objectives and incorporate sustainability into the core strategies at Monarch – including our day-to-day operations and communications. Monarch’s future impact objectives include:

1. Carbon Neutrality

Monarch has and will be implementing several initiatives (detailed below) that will help us reach carbon neutrality by the end of 2035.

- Currently more than 50% of Monarch’s employees work in LEED, EarthCraft, or Energy Star certified buildings.

- Monarch reduced their office space by 40% by year end 2022.

- Monarch implemented work from home policies.

- Provide tax equity, develop, own and/or manage renewable energy projects resulting in the removal of CO2 emissions.

- Reduce Monarch’s kilowatt consumption in its offices by 5%, reduce paper consumption by 5%, and reduce plastic bottle usage by 10%.

- All new office space(s) will be located in LEED, EarthCraft, or Energy Star certified buildings.

- Focus on increased use of technology for seamless digital collaboration such as video conferencing to limit unnecessary travel.

2. Home Development and Job Creation

Monarch will contribute to the creation of jobs and affordable homes by engaging in the following activities:

- Provide tax equity, develop, own and/or manage renewable energy projects resulting in the creation of jobs.

- Provide tax equity, develop, own and/or manage affordable housing developments resulting in the creation of affordable homes and jobs. As a part of its commitment to impact investing, Monarch created its Social Bond Framework to guide current and future issuance of social bonds, such as its inaugural social bond issuance.

- Provide tax equity and/or manage the rehabilitation of historically significant buildings resulting in the creation of jobs.

3. ESG Committee

Monarch has appointed an ESG committee to oversee the implementation of ESG initiatives into day to day practices including the following:

- Incorporate ESG criteria into Monarch’s investment opportunities.

- Assess the impact of our federal investment opportunities.

- Regularly communicate, both internally and externally, the benefits of ESG.

- Continue to increase affiliation and active participation in environmental organizations/associations.

- Encourage and engage our investors, stakeholders, and vendors to pursue sustainability initiatives.

4. Monarch’s Annual Impact Report

Monarch will evaluate our goals and initiatives by producing an annual report.

5. Employee/Employer Relationship

Monarch’s strives to provide a healthy and safe workplace where mutual respect is key and individuals feel valued. Our professional environment will be free from any discrimination on the basis of race, color, religion, sex (including gender identity, sexual orientation, and pregnancy), national origin, age (40 or older), disability or genetic information. Monarch is committed to the personal and professional growth of our employees – we will encourage our employees to advance their industry knowledge and skills through conferences, industry organizations, and training. Additional steps include, but are not limited to:

- Performance Communication – conducting regular meetings (or quarterly/semiannual) regarding corporate performance.

- Healthcare Coverage – providing healthcare options that exceed the national average of healthcare costs provided by other employers.

- Retirement Benefits – continuing to offer a competitive 401(k) retirement benefit plan.

- Annual Diversity Training – training our employees and managers in better skills for promoting an open-minded, diverse workplace.

- Improved Recruiting – implementing a new recruitment process to enable more access to diverse candidates.

6. Giving Back

Sponsor and/or support charitable organizations, increase volunteerism or community engagement while encouraging employee participation.

Affiliated Organizations & Community Activities

View the organizations and affiliations Monarch partners with to impact the community.