We are pleased to present the full recording of our “Lights. Camera. America!” panel discussion, an event that took place during the 2025 Sundance Film Festival. This timely conversation addresses the critical role of film incentives in supporting domestic production, preserving American jobs, and ensuring the United States’ continued leadership in the global film industry.

Moderated by Marco Cordova, the panel features insights from leading industry experts: Allison Whitmer (Montana Film Commissioner), Dave DeVore (Netflix), Steven Demmler (Talon Entertainment Finance), Chiquita Banks (Bankable Consulting, Inc.), and Fred Siegel (Fred Siegel CPA). The discussion highlights the importance of federal, state, and local incentives, and explores the potential impact of establishing a Federal Film Office.

Thank you to our amazing partners at Film USA for co-hosting this event and to our Media Partner, Georgia Entertainment. For inquiries regarding hosting a similar event, please contact Marco Cordova.

Georgia Entertainment recently released the names of the 200 Most Influential of Georgia’s Creative Industries. The individuals are highlighted in the bi-annual printed publication – Georgia Entertainment: The Creative Economy Journal. See the digital version. Our 200 Spotlight series showcases many of those that were included.

By Carol Badaracco Padgett, Senior Writer

Robin Delmer champions the role of the arts in economic development. And when you ask him why, he gives a definite response: “Throughout my life I’ve been passionate about fostering creativity and innovation. Whether through my interest in music, involvement in film, supporting the High Museum, or backing the Atlanta Ballet, I’ve consistently worked to promote the growth and sustainability of creative industries.”

A visionary leader armed with a Bachelor of Science in Economics from Vanderbilt University in Nashville, Tennessee, Delmer identifies tax equity and impact-related investment opportunities, introducing influential investors to projects across key sectors. Among them, renewable energy, affordable housing, and historic preservation – with film and entertainment standing out.

Through his leadership at Atlanta-based Monarch Private Capital, Delmer sees and then facilitates opportunities for investment and social impact to merge and flourish. And he works diligently to make the most of the union, shaping a more vibrant, inclusive, and prosperous Creative Economy in the process.

Read the full feature article here.

As we approach the final tax return filing deadline for individual and corporate taxpayers, there is increased activity in the market for Georgia film tax credits as well as Georgia low income housing tax credits. This article will briefly overview both programs and help provide clarity for taxpayers who are looking to utilize tax credits to reduce their Georgia state liability.

What is the same?

Both the GA film credit and the GA low income housing credit are generated based on a percentage of qualified expenditure from the respective projects. When the entities that generate these credits cannot also utilize them, they can be transferred tothird party taxpayers at a discounted price to their face value.

Both credits are treated as property and therefore have similar tax treatment. In both cases, a capital gain is recognized on the day a tax return is filed claiming the credits. The amount of the gain is calculated as the face value of the credits less the investor’s basis. Taxpayers can maximize their return on investment by holding credits for one-year prior to filing their Georgia tax returns, consequently recognizing the capital gain at long-term rates instead of short-term rates.

Both of these credits are able to be carried forward from the year they are generated. Film credits carry forward five years, and low income housing credits carry forward for three years.

What is the risk? Recapture risk is similar between both credits. There is an increased level of assurance with the low income housing credits because the risk is diversified. Monarch creates a fund made up of several low income housing projects, and investors receive a portion of credits from each of the projects to make up their total allocation of credits.

What is different?

The main difference between the two credits is how the transfer of the credit is facilitated.

Film credits are referred to as transferrable credits. This means that credits can be transferred directly from a production studio to a taxpayer. The taxpayer receives a Form IT-TRANS as evidence of the transfer, then the IT-TRANS is used by the taxpayer to claim the film credits on their Georgia return. This is typically the preferred method of transfer because of how easy the process is. It is a one-time transaction, and the transfer is completed within five business days of the taxpayer funding their investment.

Low income housing credits are referred to as allocable credits. This means that taxpayers subscribe to a partnership fund created by Monarch and are allocated low income housing credits through a K-1. Taxpayers are deemed to have acquired an intangible asset, a tax credit, and to have made a partnership investment. A small portion of the taxpayer’s investment is allocated to their partnership capital account (1%), and the majority of the investment is allocated to their basis in the credits (99%). Investors will receive an allocation of credits through a K-1 and will then receive blank K-1’s for the next four years. The partnership dissolves after five years, and the investor gets to recognize a small capital loss equal to the amount of their investment allocated to their capital account.

Timing

Low income housing credits are less flexible in terms of the timing of purchase. The credits need to be bought during the tax year in which they will be applied against. So, if you are purchasing low income housing credits to be used on your 2020 tax return, they need to be purchased during 2020. This is because these credits are allocable, and investors need to be subscribed to a fund during the year in which they wish to receive credits.

Because film credits are transferrable, they are more flexible when it comes to the timing of purchase. You can buy 2019 film credits during 2020 to apply against your 2019 tax liability. Similarly, as long as you are still within the statute of limitations, you can buy film credits from a prior year, amend your prior year return, and receive an increased refund.

Another difference between the two credits is the price.

Low income housing credits are typically priced lower than film credits. The after-tax return for low income housing credits is around 14%, compared to an approximate 10% after-tax return for film credits.

Low income housing credits can also be bought in multiple year increments. When bought in multiple year increments, the return to investors greatly increases. This is because of a further discounted price as well as more favorable tax treatment.

For more information, please contact Ryan Degnan by emailing rdegnan@monarchprivate.com.

Monarch Private Capital, a nationally recognized tax-advantaged investment firm that develops, finances, and manages a diversified portfolio of projects that generate both federal and state tax credits, is pleased to announce the launch of a new website for its film & entertainment division, Monarch Film Credits, located at www.monarchfilmcredits.com.

Monarch Film Credits is one of the nation’s largest tax credit placement specialists and the market leader for placing Georgia film tax credits. Working primarily with major studios and larger independent production companies, Monarch Film Credits assists with all transferable state film tax credits, including California, Connecticut, Georgia, Illinois, Massachusetts, Montana, Nevada, New Jersey, Pennsylvania, and Rhode Island.

The division has brokered more than $800 million in film tax credits since Monarch began working with these types of programs in 2006. Because of the rapid growth of Monarch’s film division and the industry’s unique and ever-changing tax credit laws and practices, Monarch Film Credits was given its own website to address the full scope of the film tax credit programs in which the company operates.

“We created a new website for our growing film tax credit division because we wanted to share our knowledge and expertise for those taxpayers interested in buying transferable state film tax credits,” said Marco Cordova, Director of Film Finance and West Coast Tax Credit Investments for Monarch Private Capital. “We also wanted to provide a better platform to promote our production tax credit offerings and help our major studio and independent production clients to sell their credits as soon as possible.”

The new easy-to-navigate and user-friendly website allows for a streamlined, best in class customer service experience for everyone. Whether a studio or production company looking to place film tax credits, or a Fortune 500 company, private company, or a high-net-worth taxpayer hoping to use film tax credits to offset their state tax liabilities at a discounted price, the new website offers valuable information for buying and selling transferable state film tax credits.

Monarch Film Credits’ new website features an interactive map that supplies users with a summary of various state tax credit programs. Taxpayers interested in buying tax credits at a discount can easily assess a state’s film tax credit benefits. Also included on the site are industry-related perspectives and insights from our well-versed tax credit experts, keeping up-to-date analyses of the latest developments in film tax credit programs across the United States.

Lastly, the website provides taxpayers a one-stop shop user experience if they are interested in both transferable film tax credits and other state tax credits that Monarch Private Capital offers. The website also provides information related to Monarch’s other state tax credit offerings, including renewable energy, affordable housing, and historic preservation tax credits. The clean design and interactive tools make it quick and easy for taxpayers to find an answer to most film tax credit questions when looking to purchase tax credits, and the skilled and experienced team at Monarch Film Credits is just a simple click away to assist with the transaction process for every client.

About Monarch Private Capital

Monarch Private Capital manages ESG funds that positively impact communities by creating clean power, jobs, and homes. The funds provide predictable returns through the generation of federal and state tax credits. The Company offers innovative tax credit equity investments for affordable housing, historic rehabilitations, renewable energy, film, and other qualified projects. Monarch Private Capital has long-term relationships with institutional and individual investors, developers, and lenders that participate in these types of federal and state programs. Headquartered in Atlanta, Monarch has offices and tax credit professionals located throughout the U.S.

ATLANTA, June 17, 2019 — Monarch Private Capital (MPC), a nationally recognized tax-advantaged investment firm that develops, finances, and manages a diversified portfolio of projects that generate federal and state tax credits, today announced that due to steady growth, the Company is implementing plans to further streamline its film finance division through a series of actions. These actions will allow MPC to continue to expand their film credit offerings while enhancing the taxpayer experience.

MPC’s film division has seen significant growth over the past 10 years as a substantial broker of tax credits to the film industry. The Company has doubled the volume of tax credits brokered in the past six years and is currently on pace to grow forty percent year-over-year. In the past 12 months alone, MPC has brokered credits that helped to produce over 70 film and television projects with most major studios, and small and large independent studios. The growth is a result of increased state tax credit programs and more interested buyers.

Anticipating cumulative growth ahead, MPC recently launched an initiative focused on enhancing the taxpayer experience, which includes integrating the film division’s back office with the robust operations of its other tax divisions. Assimilating these divisions not only enables a more streamlined process, but also provides access to additional, knowledgeable resources which will provide taxpayers with faster turnaround times.

In addition, MPC named Marco Cordova to lead the film division during this expansion process. Cordova is a recognized expert in the field of film tax credits and movie production incentives with over 20 years of industry experience. As Director of Film Finance and West Coast Tax Credit Investments, he is responsible for overall planning, investment strategy and acquisition of film, television and digital entertainment tax credits. In addition, he is responsible for expanding MPC’s federal and state tax credit placement and investment opportunities to Fortune 1000 companies and large corporate entities with a focus on entertainment, historic, renewable energy, and low income housing projects. Cordova’s extensive tax expertise and deep knowledge of various tax credit programs, coupled with being based in Los Angeles, will be instrumental in his success in this expanded role.

“We’ve enjoyed tremendous growth in our film division which is largely a result of the awareness and acceptance of state tax incentives for film and television productions and we see even more opportunities ahead,” said George L. Strobel II, Co-CEO & Managing Director of Tax Credit Investments. “In order to enhance the taxpayer experience, we are streamlining our internal processes while we also expand our credit offerings. We’re excited to move Marco into leading the division, not only because he has played an important part in our success but because he has the breadth and depth of experience to help us develop the products our investors are looking for.”

Prior to MPC, Cordova was with Entertainment Partners (EP) where he worked with Fortune 500 companies, major studios, and Indie production companies to place hundreds of millions in film and non-film tax credits. Cordova was also instrumental in expanding EP’s service offerings in over a dozen states and edited several international and domestic production incentives publications. Prior to EP, Cordova worked at Sony Pictures Entertainment, overseeing multistate taxes and film incentives. Cordova started his career at Deloitte Tax and Arthur Andersen, specializing in domestic taxes for the entertainment industry.

For more information on MPC’s film products, please contact Marco Cordova by emailing mcordova@monarchprivate.com or calling (213) 863-0718.

About Monarch Private Capital

Monarch Private Capital positively impacts communities by investing in tax credit supported industries. The company is a nationally recognized tax equity investor providing innovative capital solutions for affordable housing, historic rehabilitations, renewable energy, film, and other qualified projects. Monarch has long term relationships with institutional and individual investors, developers, and lenders that participate in these types of federal and state programs. Headquartered in Atlanta, Monarch has offices and tax credit professionals located throughout the U.S.

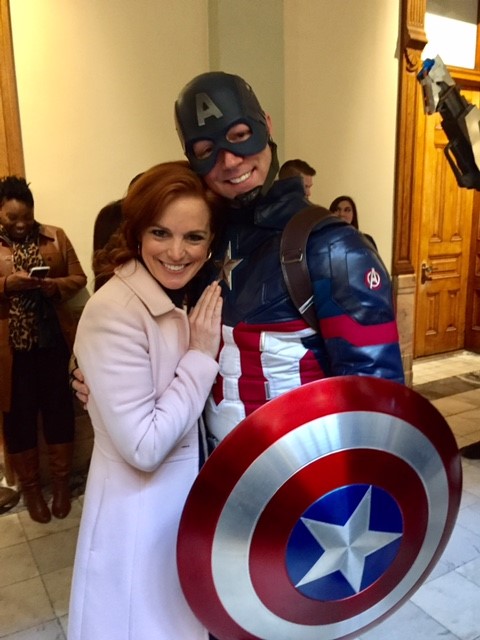

Monarch Private Capital has been a longtime supporter of the Georgia film industry, recently hosting a panel discussion with other businesses at Sundance Film Festival promoting the benefits of film making in Georgia. Yesterday, the company turned out to show its support again at the state capitol for Georgia Film Day.

Hosted by the Georgia Film, Music & Digital Entertainment Office, the program included Speaker David Ralston’s official designation of 25 new camera-ready counties bringing the total number to 136 holding the designation.