Rising Costs Put Pressure on LIHTC Deals

Affordable Housing Finance

Companies discuss the post–tax reform market.

Increased construction costs and rising interest rates are among the sleep-stealing concerns going into the second half of the year for low-income housing tax credit (LIHTC) syndicators.

An escalation on either front could widen budget gaps and threaten to make already tight LIHTC deals even more difficult to pencil out.

These issues have been building over time, with no relief in sight. More specifically, construction costs increased for the 21st straight month in July, according to IHS Markit (Nasdaq: INFO) and the Procurement Executives Group, which note that steel prices in the U.S. are at or near peak levels, and labor costs continue to increase in all regions of the country.

The increased cost of construction and financing is one way that 2018 deals differ from those in 2017, says Mike Jacobs, senior vice president of originations at National Equity Fund (NEF).

To help, some states have issued state housing tax credits or other gap financing programs, report syndicators. “We’re also seeing a rise in the number of hybrid 4% and 9% credit combination deals in ones that are underallocated,” Jacobs says. “This creativity is good, but the added complexity makes deals much tougher to close.”

Rising interest rates and construction costs are creating problems for both newly allocated deals and deals that have closed on their financing but haven’t completed construction or met rental achievement, says Stacie Nekus, senior vice president, investor relations, at Alliant Capital.

One trend with properties in construction or about to enter construction is increased costs due to material price increases—some from trade-tariff market jitters—and labor shortages. This may lead to problems related to construction contingencies, placed-in-service deadlines, and the need to restructure financing, she says.

The good news is that there’s been an uptick in the Department of Housing and Urban Development’s area median incomes in certain markets, which may help offset the issues, according to Nekus.

“A significant rise in interest rates has been a topic of discussion since the 2016 election, and while there has been an increase in rates, most debt products have maintained historically low interest rates,” adds Robin Delmer, co-CEO and managing director of acquisitions at Monarch Private Capital. “If economic forces start to drive rates higher at a more rapid pace, then that could have a significant impact on 4% projects nationwide.”

Related Posts

Monarch Private Capital Closes on Tax Equity Financing for Affordable Housing and Historic Rehabilitation of 1904 Farnam in Omaha, Nebraska

Sep 26, 2024

$25 Million Project to Deliver Affordable Housing and Restore Historic Landmark in Downtown Omaha by 2025 ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm […]

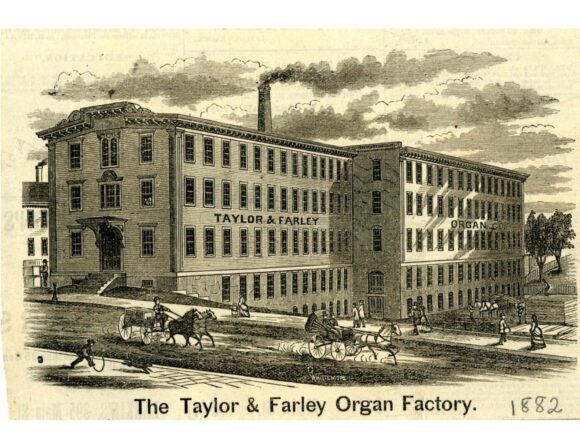

Novogradac Article: HTCs Help Compose New Song for Former Taylor and Farley Organ Factory in Worcester, Massachusetts

Jan 31, 2025

Nick Decicco, Senior Writer, Novogradac A former organ factor in Worcester, Massachusetts, with history reaching back to the mid-19th century is set for a future as 36 apartments thanks to […]

Monarch Private Capital Announces Successful $275 Million Bond Issuance Led by HSBC

Feb 6, 2025

Proceeds will help build sustainable communities through affordable housing. Atlanta, GA – Monarch Private Capital, a nationally recognized tax-advantaged investment firm, proudly announces a $275 million bond issuance to finance […]