South Carolina to Offer State Affordable Housing Tax Credits

The South Carolina Legislature has passed House Bill 3998, the Workforce and Senior Affordable Housing Act, creating a state tax credit for qualified affordable housing developments.

The South Carolina State Housing Finance and Development Authority sees this as a significant step toward addressing the affordable housing crisis in South Carolina and providing safe, decent and affordable housing for all South Carolinians. Housing will begin allocating this tax credit in the 2020 application cycle.

Our mission is to create quality affordable housing opportunities for citizens of South Carolina.

The Housing Tax Credit Program (LIHTC) is designed to provide for-profit and nonprofit developers with an incentive to create and maintain affordable housing. This is the country’s most extensive affordable housing program.

Our mission is to create quality affordable housing opportunities for citizens of South Carolina.

The Housing Tax Credit Program (LIHTC) is designed to provide for-profit and nonprofit developers with an incentive to create and maintain affordable housing. This is the country’s most extensive affordable housing program.

Owners of and investors in qualifying developments can use the credit as a dollar-for-dollar reduction of federal income tax liability. Allocations of credits are used to leverage public, private and other funds in order to keep rents to tenants affordable.

– SC Housing

Related Posts

Monarch Private Capital Announces Successful $275 Million Bond Issuance Led by HSBC

Feb 6, 2025

Proceeds will help build sustainable communities through affordable housing. Atlanta, GA – Monarch Private Capital, a nationally recognized tax-advantaged investment firm, proudly announces a $275 million bond issuance to finance […]

Monarch Private Capital Closes LIHTC Equity Financing for Walnut Street Phase I in Massachusetts

Mar 26, 2025

$43 Million Project to Deliver Affordable Housing for Massachusetts Communities ATLANTA, March 26, 2025 (GLOBE NEWSWIRE) – Monarch Private Capital, a nationally recognized impact investment firm that develops, finances, and manages […]

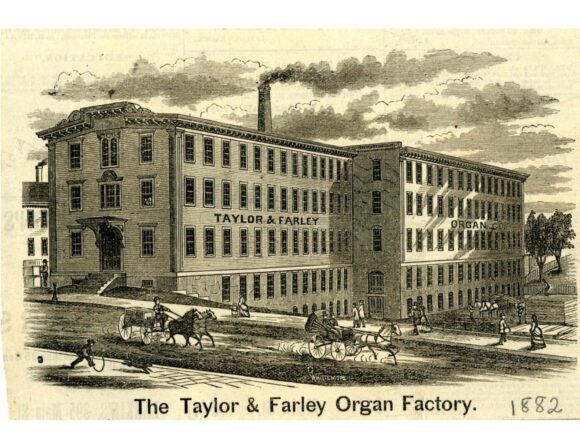

Novogradac Article: HTCs Help Compose New Song for Former Taylor and Farley Organ Factory in Worcester, Massachusetts

Jan 31, 2025

Nick Decicco, Senior Writer, Novogradac A former organ factor in Worcester, Massachusetts, with history reaching back to the mid-19th century is set for a future as 36 apartments thanks to […]