Monarch Private Capital Finances the Rehabilitation of Historic Landmark in New Orleans

Redevelopment of historic landmark to breathe new life into iconic Bank of New Orleans Building

Monarch Private Capital, a nationally recognized impact investment firm that develops, finances, and manages a diversified portfolio of projects generating both federal and state tax credits, is pleased to announce the financial closing of the redevelopment and preservation of the former Bank of New Orleans Building in New Orleans. Monarch Private Capital provided tax credit equity in conjunction with federal historic tax credits associated with the property.

This historic landmark will be repurposed into two hotel properties, including the illustrious Fairmont New Orleans, commercial space and parking. This marks the eagerly awaited return of the iconic Fairmont brand to the heart of the city. Anticipated to debut in the summer of 2025, the Fairmont New Orleans promises to redefine luxury accommodations in the Central Business District, adjacent to the cherished and historic French Quarter.

The Bank of New Orleans Building, located at 1010 Common Street, holds significant historical value as a symbol of the city’s economic prowess and architectural legacy. Originally designed by the renowned architects Skidmore, Owings & Merrill, the structure was completed in 1970 and stands as a testament to International Style architecture, embodying the spirit of its era. Now being repurposed and redeveloped by Louisiana-based developer Kailas Companies, this architectural gem is slated for a unique transformation.

“The rehabilitation of the former Bank of New Orleans Building reflects our dedication to involvement with impactful investments which help revitalize communities while safeguarding their cultural legacy,” stated Rick Chukas, Partner and Managing Director of Historic Tax Credits. “Collaborating with the Kailas Companies and the other parties involved to transform this historic property into a pinnacle of luxury and hospitality was truly a privilege. We are thrilled to be part of this project that will set a new standard of excellence in the heart of New Orleans.”

For more information on Monarch Private Capital and its impact investment funds, please email Rick Chukas at rchukas@monarchprivate.com.

About Monarch Private Capital

Monarch Private Capital manages impact investment funds that positively impact communities by creating clean power, jobs, and homes. The funds provide predictable returns through the generation of federal and state tax credits. The Company offers innovative tax credit equity investments for affordable housing, historic rehabilitations, renewable energy, film, and other qualified projects. Monarch Private Capital has long-term relationships with institutional and individual investors, developers, and lenders participating in these federal and state programs. Headquartered in Atlanta, Monarch has offices and professionals located throughout the United States.

Related Posts

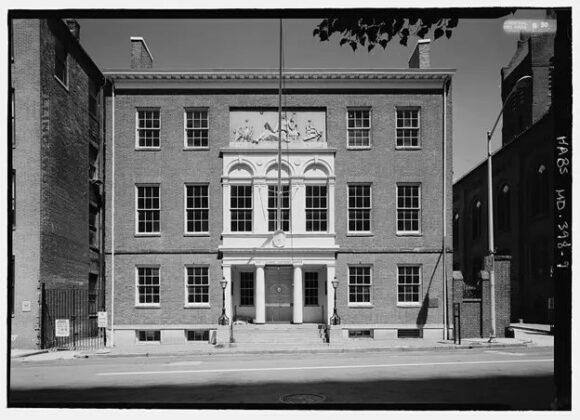

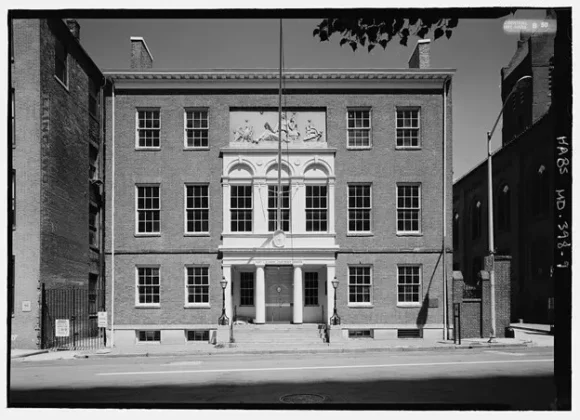

The Phoenix Award: The Peale Center for Baltimore History and Architecture

Oct 19, 2023

We’re thrilled to announce that The Peale has received the prestigious Phoenix Award from Preservation Maryland as part of their 2023 Best of Maryland Award Winners. These awards honor excellence […]

The Peale Wins 2024 Buildy Award

Mar 8, 2024

The Peale Center for Baltimore History and Architecture (The Peale) brings new life to the first purpose-built museum in the Americas, both architecturally and organizationally. The Peale’s National Historic Landmark building was […]

Monarch Private Capital Helps Drive Economic Growth in South Carolina Through Tax Credit Investments

Dec 2, 2024

ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm, is proud to support South Carolina’s rapid economic growth. According to U.S. Census Bureau data, South […]

Affordable Housing Company Announcements Historic Rehabilitation