We will keep you informed on what’s happening at Monarch.

Treasury Releases Second Set of Highly Anticipated Opportunity Zone Guidance

Apr 17, 2019

The U.S. Department of the Treasury issued its second set of proposed regulations related to the new Opportunity Zones (OZ) tax incentive. The guidance makes it easier for funds to […]

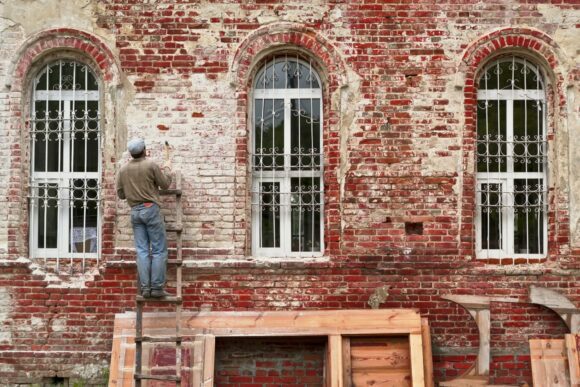

Federal Tax Incentives for Rehabilitating Historic Buildings

Mar 12, 2019

Annual Report for Fiscal Year 2018 National Park Service, U.S. Department of the Interior, Technical Preservation Services A Successful Federal/State Partnership Since 1976 The Federal Historic Preservation Tax Incentives Program, […]

Historic Renovations Hinge on Intricate Numbers Game

Feb 25, 2019

The following are excerpts from an article written by Melinda Waldrop that appeared in a print version of the Columbia Regional Business Report. Feb. 25 FOCUS: Banking and Finance Historic Renovations […]

The Tax Credit that is History in the Re-Making

Feb 4, 2019

Forbes article by Bill Frist At a time when our nation feels like it may be torn apart with increasing partisanship and clash of cultures, there is something all Americans […]

NPS Reports $6.5 Billion in Historic Rehabilitation Investment in FY 2017

Oct 23, 2018

Annual Report on the Economic Impact of the Federal Historic Tax Credit for FY 2017 The National Park Service (NPS) certified 1,035 completed historic rehabilitation projects and documented $6.5 billion […]

Rising Costs Put Pressure on LIHTC Deals

Aug 28, 2018

Affordable Housing Finance Companies discuss the post–tax reform market. By Donna Kimura Increased construction costs and rising interest rates are among the sleep-stealing concerns going into the second half of the […]

IRS Guidance on Tax Reform

May 24, 2018

IRS Guidance on Tax Reform – Payments Made in Exchange for State and Local Tax Credits On May 23rd, 2018, the U.S. Department of the Treasury and the Internal Revenue […]

Atlanta Commits To 100 Percent Renewable Energy By 2035

May 3, 2017

The city becomes the 27th in the U.S. to pledge to go totally green. By Chris D’Angelo WASHINGTON — Atlanta lawmakers approved a measure on Monday aimed at powering the […]

NC Green Energy Industry Employs 34,000 according to Census

Mar 25, 2017

By Bruce Henderson North Carolina renewable energy and energy efficiency businesses have created the equivalent of 34,000 full-time jobs and generate $6.4 billion a year in revenue, an industry group […]