Monarch Private Capital Finances Historic Rehabilitation of New York and New Jersey Telephone Exchange Building

$59 Million Redevelopment Will Restore Brooklyn Landmark and Offer Luxury Housing by 2026

ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, finances, and manages a diversified portfolio of projects generating both federal and state tax credits, is pleased to announce the tax equity closing for the historic rehabilitation tax credit (HTC) equity for the $59 million redevelopment of the New York and New Jersey Telephone Exchange Building. Located at 601-619 Throop Avenue, at the corner of MacDonough Street, in the Stuyvesant Heights neighborhood of Brooklyn, this historic landmark will be transformed into 40 luxury apartments with 1,250 sf of commercial space on the ground and basement levels.

The project, led by Rivington Company LLC, will restore the Italian Renaissance Revival building, originally designed by Alexander MacKenzie of Eidlitz & MacKenzie in 1905. The redevelopment will preserve the building’s historical significance while offering modern amenities.

This initiative not only revitalizes a historic landmark but also contributes to the ongoing revival of the Stuyvesant Heights neighborhood. The building’s past includes its role as a telecom hub, facilitating communication for Brooklynites at the turn of the 20th century. Its transformation into luxury apartments marks a new chapter, offering much-needed housing options while preserving its architectural heritage.

“We are proud to partner with Rivington Company in this impactful project,” said Rick Chukas, Partner, Managing Director of Historic Tax Credits for Monarch Private Capital. “This project, our first rehab in Brooklyn, is a great example of how history can be preserved while meeting modern living needs.”

“Rivington Company is proud to announce a successful partnership with Monarch to preserve and convert the historic landmark building located in the heart of Stuyvesant Heights into much-needed housing. This collaborative effort not only honors the rich architectural heritage of the neighborhood but also addresses the pressing demand for multifamily housing in this vibrant neighborhood,” said Travis Stabler, Managing Partner at Rivington Company. “Together, we are not only breathing new life into a historic building but also creating homes that will support the diverse needs of our community.”

For more information on Monarch Private Capital and its impact investment funds, please email Rick Chukas at rchukas@monarchprivate.com.

About Monarch Private Capital

Monarch Private Capital manages impact investment funds that positively impact communities by creating clean power, jobs, and homes. The funds provide predictable returns through the generation of federal and state tax credits. The company offers innovative tax credit equity investments for affordable housing, historic rehabilitations, renewable energy, film, and other qualified projects. Monarch Private Capital has long-term relationships with institutional and individual investors, developers, and lenders participating in these federal and state programs. Headquartered in Atlanta, Monarch has offices and professionals located throughout the United States.

Related Posts

Monarch Private Capital Finances First State LIHTC in Indiana

Jul 18, 2024

$29 Million Multifamily Community Coming to Muncie as a Result of Recent Legislation ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, finances, […]

Monarch Private Capital Closes LIHTC Equity Financing for Patterson Point in Goleta, CA

Nov 6, 2024

$24 Million Project to Deliver Affordable Housing for Vulnerable Populations in Goleta, CA ATLANTA, November 4, 2024 (GLOBE NEWSWIRE) – Monarch Private Capital, a nationally recognized impact investment firm that […]

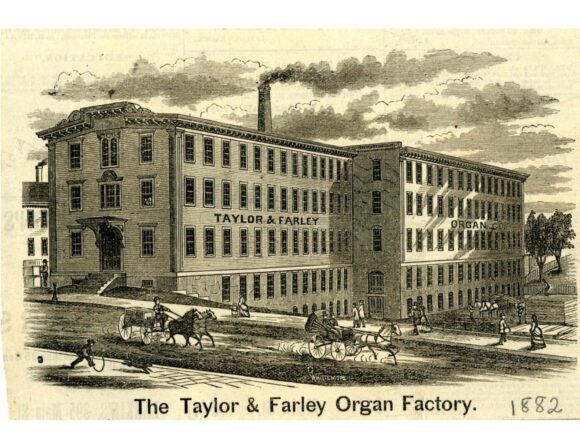

Novogradac Article: HTCs Help Compose New Song for Former Taylor and Farley Organ Factory in Worcester, Massachusetts

Jan 31, 2025

Nick Decicco, Senior Writer, Novogradac A former organ factor in Worcester, Massachusetts, with history reaching back to the mid-19th century is set for a future as 36 apartments thanks to […]