Monarch Private Capital Finances Historic Worcester Landmark

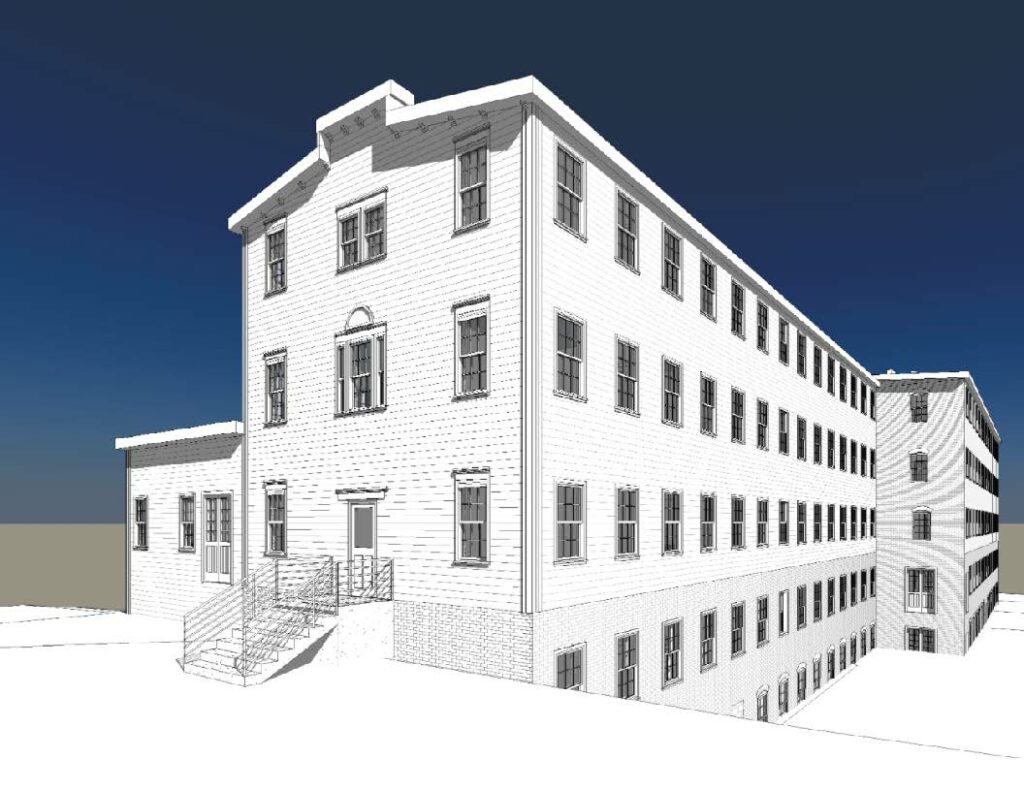

$13.5 Million Project to Transform Former Organ Factory into 36 Residential Units, Including Market-Rate and Affordable Housing

ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, finances and manages a diversified portfolio of projects generating both federal and state tax credits, is pleased to announce the closing of tax equity financing for the rehabilitation of a historic building in Worcester, Massachusetts. This $13.5 million project, led by GoVenture Capital Group, LLC, will transform the historic property into 36 residential units, offering 31 market-rate apartments and 5 affordable units to meet the diverse housing needs of the community.

The building sits on the former site of the Taylor and Farley Organ Company, a notable Worcester manufacturer that operated from 1855 to 1885, producing reed organs that were highly regarded during the 19th century. The redevelopment of this historic site honors the city’s rich industrial past while providing modern housing solutions for today’s residents.

“We’re thankful to be part of the Taylor Farley project. Converting the building’s use not only breathes new life into the property but also provides desperately needed housing in an area that needs it the most,” said Brendan Gove, President of GoVenture Capital.

The financing includes both state and federal Historic Tax Credits (HTCs), reinforcing Monarch’s commitment to supporting community revitalization through the preservation of historic landmarks. The development is set to be completed by January 31, 2026.

The project will breathe new life into one of Worcester’s notable historic structures, retaining its architectural significance while adapting the building to modern residential standards. In addition to market-rate housing, the project will include five affordable units designed to accommodate residents earning a percentage of the Area Median Income (AMI), enhancing the accessibility of quality housing in the area.

“We’re proud to be part of a project that not only preserves a piece of Worcester’s rich history but also addresses the city’s housing needs in a meaningful way,” said Rick Chukas, Partner and Managing Director of Historic Tax Credits at Monarch Private Capital. “This development perfectly aligns with our mission to support community growth through historic preservation and affordable housing, and we look forward to its positive impact on the Worcester community.”

Monarch Private Capital’s involvement in this project highlights its dedication to community development, historic preservation and affordable housing. By blending modern living with historical charm, the Worcester project contributes to the city’s ongoing growth and revitalization.

For more information about Monarch Private Capital and its impact investment funds, please email Rick Chukas at rchukas@monarchprivate.com.

About Monarch Private Capital

Monarch Private Capital manages impact investment funds that positively impact communities by creating clean power, jobs and homes. The funds provide predictable returns through the generation of federal and state tax credits. The Company offers innovative tax credit equity investments for affordable housing, historic rehabilitations, renewable energy, film and other qualified projects. Monarch Private Capital has long-term relationships with institutional and individual investors, developers, and lenders participating in these federal and state programs. Headquartered in Atlanta, Monarch has offices and professionals located throughout the United States.

About GoVenture Capital Group

Based out of Worcester, MA, GoVenture acquires, develops, and manages residential and commercial properties that contribute to the vitality and growth of our local communities. GoVenture’s philosophy is focused on maintaining a creative and flexible approach to all opportunities, while formulating a plan that generates the greatest value for all stakeholders.

GoVenture targets gateway markets and select urban and suburban markets that have key indicators showing liquidity, population growth, economic diversity, and other positive demand trends. Founded in 2018 and built on a foundation of discipline, innovation, sustainability, and integrity, we seek partners that embody the same values.

Related Posts

Monarch Private Capital Closes on Tax Equity Financing for Affordable Housing and Historic Rehabilitation of 1904 Farnam in Omaha, Nebraska

Sep 26, 2024

$25 Million Project to Deliver Affordable Housing and Restore Historic Landmark in Downtown Omaha by 2025 ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm […]

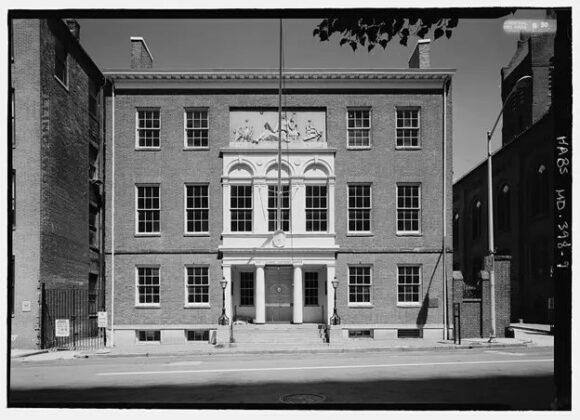

The Phoenix Award: The Peale Center for Baltimore History and Architecture

Oct 19, 2023

We’re thrilled to announce that The Peale has received the prestigious Phoenix Award from Preservation Maryland as part of their 2023 Best of Maryland Award Winners. These awards honor excellence […]

Monarch Private Capital Finances Historic Rehabilitation of Iowa Mutual Insurance Building

Apr 29, 2024

Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, finances, and manages a diversified portfolio of projects generating both federal and state tax credits, is pleased to […]