Monarch Private Capital Finances the Rehabilitation of Atlanta’s Grant Building

Redevelopment of a historic landmark creates market-rate rental units, commercial and retail space

Monarch Private Capital, a nationally recognized impact investment firm that develops, finances, and manages a diversified portfolio of projects generating both federal and state tax credits, is pleased to announce the financial closing of federal and State of Georgia historic rehabilitation tax credit equity for the $28 million redevelopment and preservation of the Grant Building in Atlanta, Georgia. This historic landmark will be repurposed into a mixed-use development consisting of commercial/retail space and market-rate residential apartments, supporting the continuing trend of growth and redevelopment in the area.

Built in 1898, the Grant Building holds historical significance as Atlanta’s earliest example of cage-steel-frame construction and the pioneering full-block occupant. Situated in the Fairlie-Poplar Historic District, in the heart of Atlanta’s downtown at 44 Broad Street, the 10-story office building became a prototype for commercial structures of the era. With its towering presence, the 135,000-square-foot building stands as one of the City’s first skyscrapers and the second oldest steel construction structure in the Southeast. The Grant Building’s architectural legacy and early contributions to the City’s skyline make it an enduring symbol of Atlanta’s growth and urban development.

The project represents a collaborative effort between two Texan groups, Wolfe Investments and Bluelofts INC. This venture marks the third transformation of the Grant Building. Of particular note, is the extensive conversion of eight floors into 165 market-rate apartment micro-units, managed by Sonder Holdings Inc. to cater to short-term occupants. Strategically situated in proximity to the expanding campus of Georgia State University, this restoration project continues to breathe new life into the historic district. It meets today’s urban housing demands by offering affordable, efficient living spaces while creating a more vibrant community.

“Monarch is honored to play a pivotal role in the revitalization of the Grant Building. Alongside Bluelofts INC. and Wolfe Investments, we’re excited about what the Grant Building project will mean to downtown Atlanta” expressed Rick Chukas, Partner and Managing Director of HTC.

For more information on Monarch Private Capital and its impact investment funds, please email Rick Chukas at rchukas@monarchprivate.com.

About Monarch Private Capital

Monarch Private Capital manages impact investment funds that positively impact communities by creating clean power, jobs, and homes. The funds provide predictable returns through the generation of federal and state tax credits. The Company offers innovative tax credit equity investments for affordable housing, historic rehabilitations, renewable energy, film, and other qualified projects. Monarch Private Capital has long-term relationships with institutional and individual investors, developers, and lenders participating in these federal and state programs. Headquartered in Atlanta, Monarch has offices and professionals located throughout the United States.

Related Posts

Monarch Private Capital Celebrates Nearly 100 Investments Transforming South Carolina Communities

Dec 5, 2024

ATLANTA, December 5, 2024 (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, finances and manages a diversified portfolio of projects generating both federal […]

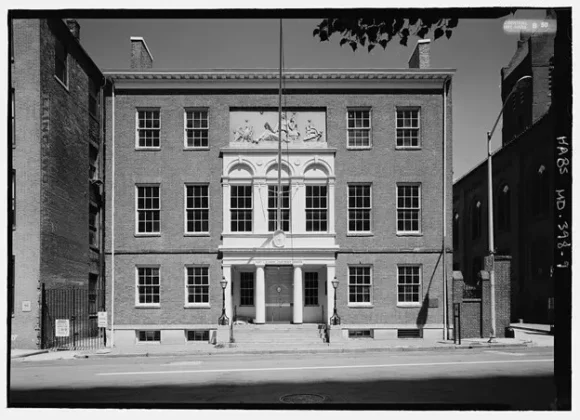

The Peale Wins 2024 Buildy Award

Mar 8, 2024

The Peale Center for Baltimore History and Architecture (The Peale) brings new life to the first purpose-built museum in the Americas, both architecturally and organizationally. The Peale’s National Historic Landmark building was […]

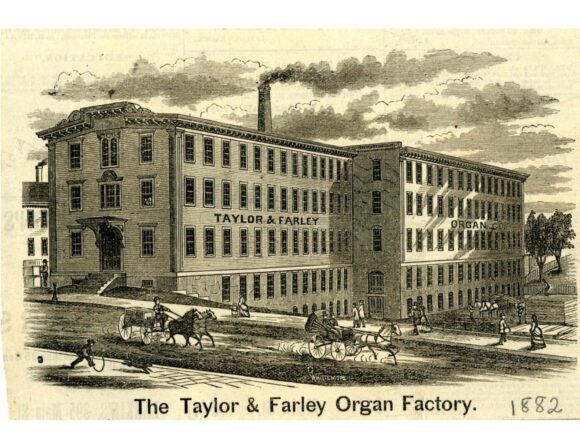

Monarch Private Capital Finances Historic Worcester Landmark

Nov 12, 2024

$13.5 Million Project to Transform Former Organ Factory into 36 Residential Units, Including Market-Rate and Affordable Housing ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment […]