Monarch Private Capital Welcomes Industry Veterans to Bolster Asset Management Team

Hayley Suminski and Kiana Wood to Enhance Project Oversight and Support Continued Company Growth

ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, finances and manages a diversified portfolio of projects generating both federal and state tax credits, is excited to announce the addition of Hayley Suminski and Kiana Wood to its Asset Management team. These strategic hires underscore Monarch’s commitment to accommodating the company’s growth and continuing to provide best-in-class oversight on our projects for our investors.

Hayley Suminski joins Monarch Private Capital as Director, Asset Management. Hayley will oversee the firm’s historic tax credit portfolio. Monarch will leverage Hayley’s knowledge of all sides of the commercial real estate business including acquisitions, underwriting analysis, portfolio management, lending parameters and capital markets solutions as the firm continues to optimize its historic tax credit portfolio and capitalize on current market opportunities. Hayley previously managed a $6.4 billion portfolio for Deutsche Bank Berkshire Mortgage and was most recently a toploan origination producer at KeyBank Real Estate Capital. She graduated cum laude with a BA in economics and a minor in finance from Simmons College.

Kiana Wood joins Monarch Private Capital as Senior Associate, Asset Management. Kiana will be overseeing Monarch’s Low-Income Housing Tax Credit (LIHTC) portfolio, leveraging her extensive experience in affordable housing. Previously, as a financial analyst at Columbia Residential, Kiana led aspects of asset performance and strategic planning for a portfolio of stabilized LIHTC multifamily properties.

“By ensuring meticulous oversight, we can enhance project outcomes, mitigate risks and deliver superior returns to our investors” said Emily DiCenso, Managing Director, Asset Management at Monarch Private Capital. “The addition of Hayley and Kiana to our team highlights our dedication to hiring industry veterans to maintain the highest standards in asset management.”

About Monarch Private Capital

Monarch Private Capital manages impact investment funds that positively impact communities by creating clean power, jobs and homes. The funds provide predictable returns through the generation of federal and state tax credits. The Company offers innovative tax credit equity investments for affordable housing, historic rehabilitations, renewable energy, film and other qualified projects. Monarch Private Capital has long-term relationships with institutional and individual investors, developers, and lenders participating in these federal and state programs. Headquartered in Atlanta, Monarch has offices and professionals located throughout the United States.

Related Posts

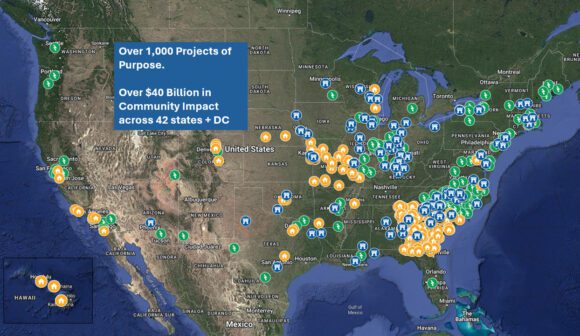

Monarch™ Private Capital Surpasses 1,000 Projects and $40 Billion in Economic Impact

Sep 30, 2025

Monarch Private Capital is proud to announce that as of Q3 2025, the firm has surpassed a major milestone — more than 1,000 projects financed and managed nationwide. Since its founding in 2005, […]

Monarch Private Capital Welcomes Michael Powley to Lead Data Innovation Across the Firm

May 29, 2025

Strategic hire underscores Monarch’s commitment to cutting-edge technology, data governance, and cross-functional excellence ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, finances, […]

Monarch Private Capital and FilmUSA Recap “Lights. Camera. America!” Panel at the 2026 Sundance Film Festival on the Future of U.S. Film Production

Feb 9, 2026

Film commissioners and other industry leaders convened Jan. 24 in Park City to discuss strengthening U.S. competitiveness, protecting domestic jobs, and responding to aggressive international production incentives ATLANTA, Feb. 9, […]