Monarch Private Capital Welcomes Industry Veterans to Bolster Asset Management Team

Hayley Suminski and Kiana Wood to Enhance Project Oversight and Support Continued Company Growth

ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, finances and manages a diversified portfolio of projects generating both federal and state tax credits, is excited to announce the addition of Hayley Suminski and Kiana Wood to its Asset Management team. These strategic hires underscore Monarch’s commitment to accommodating the company’s growth and continuing to provide best-in-class oversight on our projects for our investors.

Hayley Suminski joins Monarch Private Capital as Director, Asset Management. Hayley will oversee the firm’s historic tax credit portfolio. Monarch will leverage Hayley’s knowledge of all sides of the commercial real estate business including acquisitions, underwriting analysis, portfolio management, lending parameters and capital markets solutions as the firm continues to optimize its historic tax credit portfolio and capitalize on current market opportunities. Hayley previously managed a $6.4 billion portfolio for Deutsche Bank Berkshire Mortgage and was most recently a toploan origination producer at KeyBank Real Estate Capital. She graduated cum laude with a BA in economics and a minor in finance from Simmons College.

Kiana Wood joins Monarch Private Capital as Senior Associate, Asset Management. Kiana will be overseeing Monarch’s Low-Income Housing Tax Credit (LIHTC) portfolio, leveraging her extensive experience in affordable housing. Previously, as a financial analyst at Columbia Residential, Kiana led aspects of asset performance and strategic planning for a portfolio of stabilized LIHTC multifamily properties.

“By ensuring meticulous oversight, we can enhance project outcomes, mitigate risks and deliver superior returns to our investors” said Emily DiCenso, Managing Director, Asset Management at Monarch Private Capital. “The addition of Hayley and Kiana to our team highlights our dedication to hiring industry veterans to maintain the highest standards in asset management.”

About Monarch Private Capital

Monarch Private Capital manages impact investment funds that positively impact communities by creating clean power, jobs and homes. The funds provide predictable returns through the generation of federal and state tax credits. The Company offers innovative tax credit equity investments for affordable housing, historic rehabilitations, renewable energy, film and other qualified projects. Monarch Private Capital has long-term relationships with institutional and individual investors, developers, and lenders participating in these federal and state programs. Headquartered in Atlanta, Monarch has offices and professionals located throughout the United States.

Related Posts

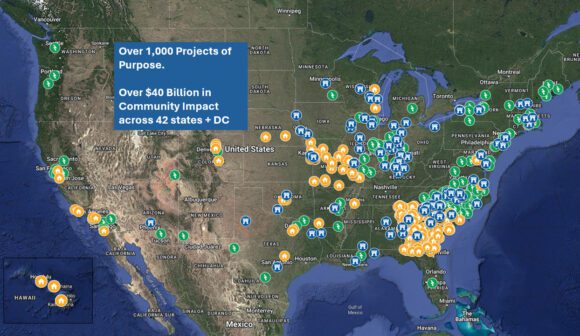

Monarch™ Private Capital Surpasses 1,000 Projects and $40 Billion in Economic Impact

Sep 30, 2025

Monarch Private Capital is proud to announce that as of Q3 2025, the firm has surpassed a major milestone — more than 1,000 projects financed and managed nationwide. Since its founding in 2005, […]

Be Open About Business: Interview with George Strobel, Co-Founder and Co-CEO of Monarch Private Capital

Jun 17, 2025

Interview by Adam Mendler Monarch Private Capital is proud to share that our Co-Founder and Co-CEO, George Strobel, was recently featured in an in-depth interview conducted by Adam Mendler, a […]

Monarch Private Capital Closes $80 Million in LIHTC Investments in June, Underscoring Market Resilience and Nationwide Reach

Jul 29, 2025

ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, finances, and manages a diversified portfolio of projects generating both federal and state tax […]