June 06, 2022 | Briefing Room Excerpt | Statements and Releases

Declaration of Emergency and Authorization for Temporary Extensions of Time and Duty-Free Importation of Solar Cells and Modules from Southeast Asia

The Federal Government is working with the private sector to promote the expansion of domestic solar manufacturing capacity, including our capacity to manufacture modules and other inputs in the solar supply chain, but building that capacity will take time. Immediate action is needed to ensure in the interim that the United States has access to a sufficient supply of solar modules to assist in meeting our electricity generation needs.

Click here to read the full announcement.

Excerpt from KWCH

Authored by Sarah Motter, Digital Producer, KWCH

On Thursday, May 5, Kansas Governor Laura Kelly says she signed House Bill 2237 to help address the state’s housing shortage with investments and incentives for residential development – especially in rural areas.

“By expanding access to quality, affordable housing, communities and businesses can better recruit and retain workers, families, and entrepreneurs in rural Kansas,” Gov. Kelly said. “This bill gives our rural communities more tools to spur economic growth vital to the economy.”

. . .

Specifically, HB 2237 enacts the Kansas affordable housing tax credit act, the Kansas housing investor tax credit act, the historic Kansas act, and the Kansas rural home loan guarantee act. The bill would authorize residential real property appraisals in rural counties to be done without finishing the sales comparison approach to value. This would allow bond proceeds under the Kansas rural housing incentive district act to be used for the development of residential homes and renovations of certain buildings in areas considered economically distressed.

To access the full article, click here.

When developers got to work in 2016 to revive The Packing House in Cambridge, Maryland, they started with the building’s pair of defining smokestacks

Excerpt from the February 2022 issue of NOVOGRADAC Journal of Tax Credits | The LIHTC Property Compliance Issue

Authored by Nick Decicco, Senior Writer, NOVOGRADAC

Formerly the Phillips Packing House, the building opened its doors almost a century ago. It evolved into a packing plant for food, supplying rations to American troops during World War II as well as supply expeditions to the North Pole.

The doors shuttered in the 1960s, marking the start of more than a half-century of decline. But now the property on Maryland’s Eastern Shore is being hauled back to life using new market tax credits (NMTCs) and historic tax credits (HTCs).

Cross Street Partners, a Baltimore-based firm that develops, constructs and manages properties as well as does its own financial advisory work, and Eastern Shore Land Conservancy (ESLC), a nonprofit based in Easton, Maryland, teamed up for the redevelopment.

“The Packing House will positively impact the community by creating career-track jobs, extend educational opportunities, encourage social connection and project a spirit of celebration.“

Rick Chukas, Partner & Managing Director of Historic Tax Credits

“The project is the first step in a broader revitalization effort to restore food access, housing and employment opportunities to Cambridge and the Eastern Shore of Maryland. The commercialization, research, production and active retail uses at the project will support local employment and inform nutrition and public health programming in the region.”

Click here to access the full article and publication (subscription required).

Excelsior Energy Capital, Monarch Private Capital, Unico Solar Investors, Oak View Group and the Seattle Kraken ice hockey team have completed three solar installations as part of the redevelopment of Climate Pledge Arena in Seattle which aims to be the first stadium in the world to be Net Zero Carbon-certified by the International Living Future Institute (ILFI).

Excerpt from Renewable Energy Magazine

Authored by Robin Whitlock

Climate Pledge Arena is the home of the Kraken ice hockey team, the four-time WNBA world champion Seattle Storm and over 80 live music and entertainment events throughout the year.

The onsite solar arrays at Climate Pledge Arena produce energy totalling 1.2 megawatts. With space for 18,100 sports fans or concertgoers, the multipurpose Climate Pledge Arena was redeveloped just in time for the Kraken’s first home game under the historic landmark roof designed by renowned architect Paul Thiry. Solar panels have been installed on the new Alaska Airlines Atrium and the First Avenue North parking garage, in addition to the Kraken Training Centre at Northgate, where the NHL’s 32nd franchise trains.

To access the full article, click here.

Excerpt from Carolina Journal’s Quick Takes

The N.C. Department of Revenue faced a legal setback last month in an ongoing fight over renewable energy tax credits. The state’s top administrative law judge rejected the department’s attempt to deny credits to a renewable energy investor.

The decision from Chief Administrative Law Judge Donald van der Vaart arrived Sept. 23 in a case pitting Integon National Insurance Company against the Revenue Department.

Integon had claimed a $1.8 million tax credit in 2016 for investments in renewable energy property. In 2020, after an audit, the Revenue Department disallowed the credit.

Integon is one of multiple renewable energy investors challenging similar rulings from Revenue staffers. Lawyers involved in a separate ongoing case from the N.C. Farm Bureau Mutual Insurance Company cited van der Vaart’s decision in their court filings.

“Unable to develop expensive renewable energy generation under North Carolina’s least-cost utility statutory structure, North Carolina’s legislature took several legislative actions to encourage private investment in renewable energy,” wrote van der Vaart, a former secretary of the N.C. Department of Environmental Quality. Van der Vaart is also a former senior fellow at the John Locke Foundation, which oversees Carolina Journal.

To access the full article, click here.

Senate Bill 1124 will help narrow the affordable housing gap and positively impact Arizona communities

Monarch Private Capital, a nationally recognized tax-advantaged investment firm that develops, finances and manages a diversified portfolio of projects that generate both federal and state tax credits, celebrates the passage of Arizona’s new state affordable housing tax credit program. The Arizona Low Income Housing Tax Credit (LIHTC) resembles the federal program but offers a new layer of coverage to better support workforce housing, expanding the positive impact for more individuals and communities throughout the state.

Arizona Governor Doug Ducey signed SB 1124 into law, establishing a state tax credit that will be equal to at least 50 percent of the Federal LIHTC available to eligible developments. The new legislation provides $4 million a year for four years to be used to finance affordable housing projects. The Arizona state LIHTC is allocable, can be carried forward up to five years, and is applicable to properties placed in service between June 30, 2022, and December 31, 2025. This new program will be the largest investment Arizona has made in affordable housing, increasing access to quality affordable homes for hardworking families and individuals across the state.

“Monarch is excited to continue working toward reducing the shortage of quality affordable housing in the United States,” said Brent Barringer, Managing Director of LIHTC at Monarch Private Capital. “With a new state affordable housing tax credit program in place, we look forward to expanding the reach of our affordable housing investments to Arizona communities, helping forge a brighter, more prosperous future for the state and its residents.”

For more information on Monarch’s programs and services, please contact Brent Barringer by emailing bbarringer@monarchprivate.com

About Monarch Private Capital

Monarch Private Capital manages ESG funds that positively impact communities by creating clean power, jobs, and homes. The funds provide predictable returns through the generation of federal and state tax credits. The Company offers innovative tax credit equity investments for affordable housing, historic rehabilitations, renewable energy, film, and other qualified projects. Monarch Private Capital has long-term relationships with institutional and individual investors, developers, and lenders that participate in these types of federal and state programs. Headquartered in Atlanta, Monarch has offices and tax credit professionals located throughout the U.S.

By Ryan Degnan, Senior Financial Operations Analyst

Georgia legislators have created a new incentive that can reduce federal tax liability. Georgia taxpayers can now benefit from an elective entity-level tax imposed on partnerships and S corporations. By moving the state tax liability of pass-through income to the entity level, individuals can reduce the amount of federal income reportable on their personal returns. This creates an avenue for partners and members of pass-through entities to work around the SALT (State and Local Tax) deduction limitation for federal purposes.

Background

The 2017 Tax Cuts and Jobs Act imposed a $10,000 deduction limitation on the combined SALT paid for individual taxpayers. Corporate taxpayers are not subject to this limitation and can deduct all SALT paid as a business expense. Several states have enacted, or are considering the enactment of, tax laws that impose either a mandatory or elective entity-level income tax on partnerships and S corporations. In response, on November 9, 2020, the IRS released Notice 2020-75, in which it announced that it plans to issue proposed regulations to clarify that SALT imposed on and paid by a flow-through entity are allowed as a deduction by the flow-through entity in computing its federal taxable income or loss for the taxable year.

Georgia House Bill 149

On May 4, 2021, Georgia Governor Brian Kemp signed House Bill 149, announcing that Georgia will be the 11th state to adopt an entity-level tax for partnerships and S corporations. Georgia’s provisions are similar to several of the other states to previously pass legislation.

The entity-level tax in Georgia is imposed at the highest state income rate, 5.75%. To comply, all owners must annually submit a consent agreement with the electing entities tax return. The electing entity receives a federal deduction equal to the amount of state and local income tax paid, without limitation. The partners and members of the entity would not recognize the income that is subject to tax at the entity level on their individual Georgia tax returns. Similarly, partners and members lose the itemized state tax deduction for income taxes paid on the pass-through income.

Example

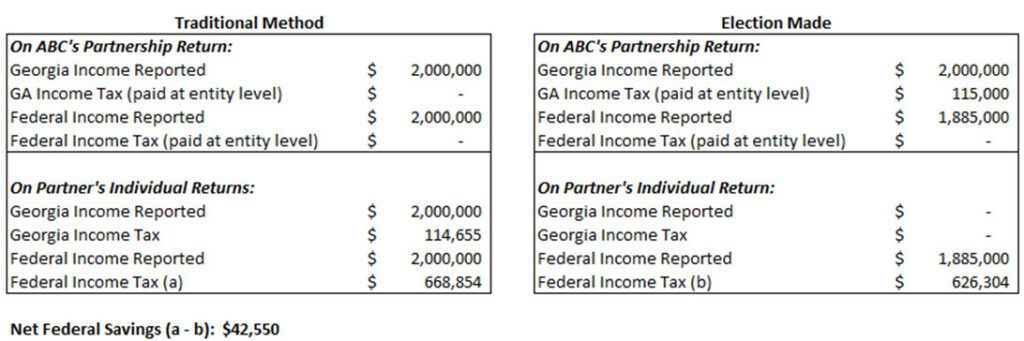

ABC partnership has two partners that are Georgia residents, each having a 50% ownership interest in ABC. ABC’s taxable income for the tax year 2022 is $2,000,000.

Analysis

We can see here that making the election shifts the state tax liability to ABC away from the individual taxpayers. The state rates under the traditional method factor in a graduated tax bracket up to the first $7,000 of income. The entity-level tax is imposed at 5.75% of all income. Therefore, the state tax liabilities are slightly different in each of the approaches. There is not expected to be a reduction in state income tax revenue resulting from entities making this election.

Under the traditional method, each partner has a Georgia liability of $57,327.50 (half of $114,827.50). However, they are both limited to a $10,000 federal deduction for SALT paid. They each lose a federal deduction of $47,327.50 in state taxes paid. In reality, assuming they pay properties taxes of $10,000 or more on their homes, they wouldn’t have benefited from any of the state income tax payment on their federal returns. If the entity-level tax election is made, ABC is allowed to deduct the entire $115,000.00 of state tax income tax on the partnership return as a business expense. This reduces the federal taxable income of ABC that is flowing through to the partners, ultimately resulting in a $42,550 federal tax savings.

It is important to remember that partners and members of electing entities can still benefit from deducting state sales tax and property taxes paid, up to $10,000, on their individual tax returns. This will lessen the effect of losing the state income tax deduction and maximize tax savings.

The hypothetical scenario presented here is an ideal situation, but the reality is usually not so cut and dry. So, what might be some disqualifiers for an entity deciding whether to make this election?

Drawback

HB 149 prohibits an electing entity or its owners from the credit for taxes paid in other jurisdictions, commonly known as reciprocity. What this means is that if an electing entity has owners in several states, the Georgia resident owners will benefit from the election at the expense of the non-resident owners. In this case, it is possible that the additional state tax burden for the non-residents could outweigh the federal tax savings. A non-resident partner or member will likely not consent to the entity-level election. This factor alone will limit the number of electing entities to ones predominately owned by Georgia residents.

In evaluating whether it is advisable to make the election to pay Georgia income tax at the entity level, there are several additional factors that should also be considered, including, but not limited to, using other state tax credits, charitable donations, making guaranteed payments to out of state partners and owner’s basis. Taxpayers should consult their tax advisors to determine the total effect of making the election.

Conclusion

The social, economic and political events of the last year have created a more dynamic work environment than ever before. Business owners are reconsidering how and where they are conducting operations. By passing HB 149, Georgia legislators have continued a trend being seen across the country of trying to attract business to their state, this time in the form of a tax incentive for owners of flow-through entities. The conditions of the bill will likely limit the number of electing entities, but those entities that meet the criteria now have an avenue to significantly reduce their federal tax liabilities through tax planning.

The pandemic has put a spotlight on the need for more affordable housing as demand outstrips supply.

Excerpt of January/February 2021 Southeast Affordable Housing Business Magazine

Authored by Jane Adler

Amid the fallout of the COVID-19 pandemic, affordable housing has taken on a new urgency. More people need a safe, stable place to live. At the same time, lost jobs and lower incomes have impacted the ability of people to pay rent, especially among those who can’t afford a market-rate apartment.

The ripple effect has stung landlords. They have loans to repay along with added operating expenses from new sanitation protocols and social distancing requirements.

Government assistance has helped to blunt the worst of the shock, at least so far. But questions remain about the challenges going forward to meet the increasing demand for affordable housing in an uncertain market. The low-income housing tax credit (LIHTC) will be a key part of the solution, according to syndicators and other industry stakeholders. They say the allocations should be increased.

Considered the most reliable resource for creating affordable housing in the country, the tax credits are also among the best examples of a successful public-private partnership.

Higher taxes could create more demand for the credits. But the lack of certainty could keep investors on the sidelines.

“Once the tax rate is settled, investors will fly back into the market.”

Brent Barringer, Managing Director of LIHTC at Monarch Private Capital

“Affordable housing is an asset class investors know and it’s safe,” says Barringer. It’s a win-win for the investor and the community. ”

Access the full article and publication here for more information on the southeastern LIHTC market.

Carlyle’s 2020 Impact Report

Electricity generation is one of the largest sources of global greenhouse gas emissions, accounting for approximately 28% of U.S. emissions alone – almost two-thirds of our electricity comes from burning fossil fuels. As renewable energy costs continue to fall, regulations tighten, and the energy transition accelerates, however, there is a large and growing investment opportunity in building the renewable energy capacity required to power a lower-carbon US electricity grid.

In 2019 Carlyle’s Renewable and Sustainable Energy Platform led a $100 million commitment to partner with Alchemy Renewable Energy on a newly-established company, Cardinal Renewables, to develop, acquire, finance and operate solar power generation projects throughout the United States – including a dozen operating assets and a pipeline of development projects.

Partnering with Carlyle’s best in class Renewable and Sustainable Energy team opens distinctive opportunities to drive forward the energy transition. Our combined deep market expertise and Carlyle’s long-standing relationships with corporations and utilities will be instrumental in enhancing project, and economic, value creation.

Lacie Clark, CEO of Alchemy Renewable Energy