Federal Tax Incentives for Rehabilitating Historic Buildings

Annual Report for Fiscal Year 2018

National Park Service, U.S. Department of the Interior, Technical Preservation Services

A Successful Federal/State Partnership Since 1976

The Federal Historic Preservation Tax Incentives Program, administered by the National Park Service in partnership with the State Historic Preservation Offices, is the nation’s most effective program to promote historic preservation and community revitalization through historic rehabilitation. With over 44,000 completed projects since its enactment in 1976, the program has leveraged over $96.87 billion in private investment in the rehabilitation of historic properties—spurring the rehabilitation of historic structures of every period, size, style, and type in all 50 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands.

The Historic Tax Credit is the largest Federal program specifically supporting historic preservation. It generates much needed jobs and economic activity, enhances property values in older communities, creates affordable housing, and augments revenue for Federal, state, and local governments, leveraging many times its cost in private expenditures on historic preservation. This widely-recognized program has been instrumental in preserving the historic buildings and places that give our cities, towns, Main Streets, and rural areas their special character and has attracted new private investment to communities small and large throughout the nation.

Related Posts

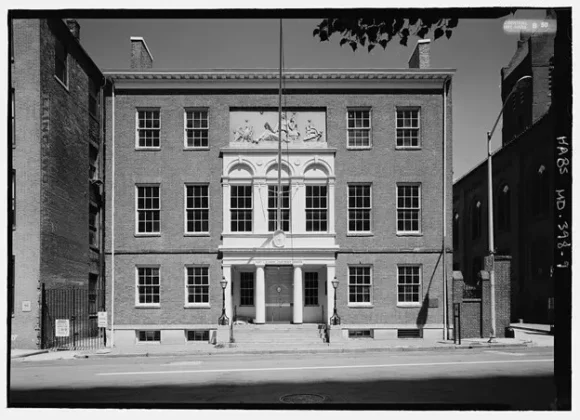

The Peale Wins 2024 Buildy Award

Mar 8, 2024

The Peale Center for Baltimore History and Architecture (The Peale) brings new life to the first purpose-built museum in the Americas, both architecturally and organizationally. The Peale’s National Historic Landmark building was […]

Monarch Private Capital Finances the Rehabilitation of Historic Landmark in New Orleans

Feb 26, 2024

Redevelopment of historic landmark to breathe new life into iconic Bank of New Orleans Building Monarch Private Capital, a nationally recognized impact investment firm that develops, finances, and manages a […]

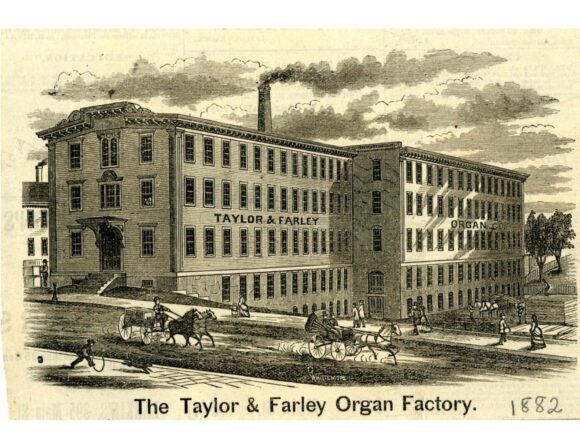

Monarch Private Capital Finances Historic Worcester Landmark

Nov 12, 2024

$13.5 Million Project to Transform Former Organ Factory into 36 Residential Units, Including Market-Rate and Affordable Housing ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment […]