Monarch Private Capital and WEDI Partner to Support a New Home for West Side Bazaar

Buffalo’s West Side Bazaar, a program of the Westminster Economic Development Initiative (WEDI), secured Historic and New Markets Tax Credit equity from Monarch Private Capital with which to invest in its multicultural community hub that supports small business owners

ATLANTA, July 19, 2022 (GLOBE NEWSWIRE) – Monarch Private Capital, a nationally recognized ESG investment firm that develops, finances and manages a diversified portfolio of projects that generate both federal and state tax credits, is pleased to announce the closing of a transaction in which they provided tax credit equity. The transaction involved the use of both Historic Tax Credits (HTC), as well as New Markets Tax Credit (NMTC) allocation provided by National Trust Community Investment Corporation (NTCIC), a national Community Development Entity (CDE). The Illinois Alcohol Company Building located at 1432 Niagara Street in Buffalo, New York will become the new home of WEDI’s West Side Bazaar and address the growing needs of the vibrant community hub. Monarch’s ESG tax equity funds are direct investments in projects that impact communities while providing predictable investment returns for its investors.

This transformative investment is indicative of Monarch Private Capital’s commitment to supporting community organizations that strive to focus on diversity, equity and inclusion. The West Side Bazaar is a well-established, in-demand culinary incubator run by Westminster Economic Development Initiative (WEDI). Currently located at 25 Grant Street in Buffalo, the Bazaar is a must-visit stop for locals, business travelers and tourists. Since its inception in 2011, it has become a crucial small business incubator where economically disadvantaged new business owners can find a safe, nurturing environment to develop their businesses with mentorship and programming for running an enterprise successfully.

The redevelopment of the Illinois Alcohol Company Building will expand the Bazaar nearly five-fold, increasing incubation space for current and new tenants and providing more seating and circulation space for customers. The reimagined and rehabilitated building will allow West Side Bazaar to continue to serve as a multicultural community hub that allows for families and neighbors to come together to share their food, cultures and lives.

“This exciting investment from Monarch Private Capital and NTCIC helps to bring WEDI closer to its capital campaign goal for the new West Side Bazaar,” said WEDI Executive Director Carolynn Welch. “While our campaign is far from over, this significant investment has a meaningful impact on our financial goal and demonstrates to our community that the new West Side Bazaar is indeed coming soon.” She continued, “WEDI’s mission is to create equity through education and by supporting underserved entrepreneurs as they build toward their own establishments and realize financial security – the Bazaar is a first expression of their brick-and-mortar dreams. The new Bazaar will be an anchor and destination on Niagara Street, demonstrating that all residents of Western New York can succeed and thrive in a culturally inclusive community.”

“Our board is dedicated to making the new West Side Bazaar a reality,” said WEDI Board Chair Stephen Zenger. “Together, we are demonstrating that Buffalo is committed to creating equity and opportunity.”

About the West Side Bazaar at 1432 Niagara Street

To accommodate the explosive growth the Bazaar has experienced and provide even more opportunities for entrepreneurs, WEDI is planning to move the Bazaar to a new location at 1432 Niagara Street in Buffalo. Scheduled to open in 2023, the new West Side Bazaar will quintuple in size and provide space for 24 restaurants, retail and professional services businesses, test and rental kitchens for independent chefs, classrooms, event space and expanded seating for many more patrons over two floors. It will also host nine full-time WEDI staff.

“Monarch is proud to be a part of this project,” said Rick Chukas, Partner & Managing Director of Historic Tax Credits at Monarch Private Capital. “The West Side Bazaar is a unique opportunity to support hard-working entrepreneurs from all backgrounds while preserving a fascinating piece of history in the process. We appreciate our partnership with WEDI, whose dedicated leadership will enable us to provide the diverse Buffalo community with even more room to grow and thrive.”

“We are excited to have played a part in the West Side Bazaar’s continued growth and success,” said Kathleen Galvan, Senior Project Manager at NTCIC. “WEDI’s dedication to the growing community of immigrant and refugee-owned businesses in the Buffalo area is truly inspiring, and we are excited to be a part of this next chapter.”

The HTC and NMTC equity will help WEDI and the entrepreneurs and clients at the West Side Bazaar in many ways, including:

- Provide a business anchor on the West Side, creating equitable paths to entrepreneurship and business ownership

- Provide minority and women-owned enterprises (MWBEs) with life-changing capital in dollar ranges not offered by any other community development financial institution in Western New York

- Support businesses being incubated through WEDI programming and provide crucial wrap-around services to support businesses to sustain and grow

- Enable emerging entrepreneurs from ethnic and racial minority communities to open small businesses and create jobs in their neighborhoods and communities

- Create equitable and inclusive development, combating gentrification/displacement – planting a stake in the ground for grassroots development in the community

- Attract surrounding neighborhood residents and tourists to patronize businesses led by minorities, women, and low-income business owners, creating a ripple effect and spreading the economic benefits in the community—advancing and creating self-sufficiency

- Provide MWBEs with transformative financial credit, eventually allowing them to borrow greater sums of capital from larger CDFIs and then banks.

About the Illinois Alcohol Company Building

Built in 1920, The Illinois Alcohol Company Building represents a significant contribution to the history of the brewing and distilling industries in Buffalo during the first half of the twentieth century. The building’s design was specifically oriented to take advantage of the transshipment corridor of Niagara Street and the railroad tracks to the west. The building also features an early use of glass block windows, included in the design in order to provide security for the goods stored inside and to hide an active bootlegging business during the Prohibition Era. In 1950 the building was sold to West Disinfecting Corporation, ending the affiliation to the history of brewing in Buffalo at that time.

About Monarch Private Capital

Monarch Private Capital manages ESG funds that positively impact communities by creating clean power, jobs and homes. The funds provide predictable returns through the generation of federal and state tax credits. The Company offers innovative tax credit equity investments for affordable housing, historic rehabilitations, renewable energy, film and other qualified projects. Monarch Private Capital has long-term relationships with institutional and individual investors, developers and lenders that participate in these types of federal and state programs. Headquartered in Atlanta, Monarch has offices and professionals located throughout the U.S.

About WEDI

As a Community Development Financial Institution (CDFI), WEDI is a trusted local leader in helping entrepreneurs gain the skills, knowledge, and network needed to run a successful & sustainable business. By providing microloans to aspiring entrepreneurs that lack access to traditional financial institutions, they are helping to uplift underserved communities and strengthen our local economy. Their expansion efforts at the West Side Bazaar will allow them to help a greater number of small, minority owned businesses build from the ground up.

About NTCIC

NTCIC, an affiliate of the National Trust for Historic Preservation, is a tax credit syndicator and CDE that utilizes a preservation-based community investment strategy of saving and repurposing blighted historic buildings across the country to spur economic and community growth. The organization partners directly with a flexible team of institutional investors to provide both NMTC allocation and tax credit equity to development initiatives that create jobs, support the clean energy movement, and provide equitable access to quality goods and services.

Related Posts

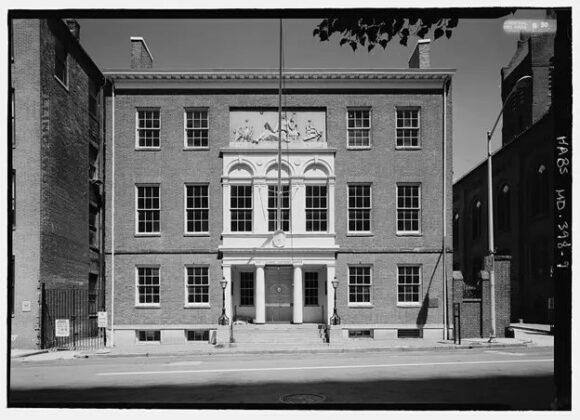

The Phoenix Award: The Peale Center for Baltimore History and Architecture

Oct 19, 2023

We’re thrilled to announce that The Peale has received the prestigious Phoenix Award from Preservation Maryland as part of their 2023 Best of Maryland Award Winners. These awards honor excellence […]

Historic Badgerow Building grand opening brings excitement to downtown Sioux City with new apartments

Aug 18, 2023

July 13th was the grand opening for apartments in the historic Badgerow Building. ”This is a beautiful and one of the most magnificent buildings in all of downtown and to […]

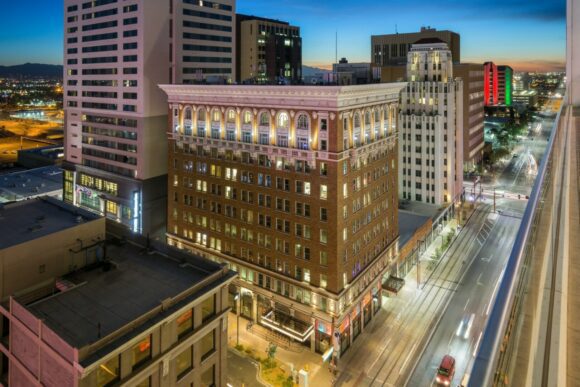

Monarch Private Capital Finances Historic Preservation of Phoenix’s First 10-Story Building

Jan 26, 2023

The reimagined Luhrs Building will provide new lodging and support the robust growth of downtown Phoenix Monarch Private Capital, a nationally recognized ESG investment firm that develops, finances and manages […]