Monarch Private Capital Announces Growth Of Historic Tax Credit Division

Expands Expertise with Hire of Industry Veteran and Internal Promotion

ATLANTA, February 3, 2020 — Monarch Private Capital (MPC), a nationally recognized tax-advantaged investment firm that develops, finances, and manages diversified portfolios of projects that generate federal and state tax credits, today announced the acquisition of additional resources to help support the continued growth in the Company’s Historic Tax Credit Division.

During 2019, the Company was involved in over $450 million[1] of historic preservation transactions which resulted in the placement of over $90 million of historic tax credits, the creation of new local jobs, and the generation of economic benefits to a variety of communities throughout the US. MPC’s Historic Tax Credit Division continues to experience steady growth and remains an integral part of the Company’s future strategy.

To continue to fuel growth, MPC has hired industry veteran, Blair Williams, to serve as the Director of Historic Tax Credit Acquisitions for the Company. Williams will be based out of Baltimore and provide additional reach into the Northeast. He has 20 years of business development and acquisitions experience working with real estate developers and sponsors involved in historic tax credits, low-income housing, and new markets tax credit transactions. Williams has closed transactions generating over $750 million in tax credits. He has served in a variety of capacities with several organizations prior to joining MPC.

“I’m excited to be a part of a company with a leading national tax credit platform that enables us to bring each piece of the capital stack together,” said Williams. “I look forward to working with our partners on innovative investments to positively impact communities.”

In addition, MPC announced the expansion of Matthew Bagwell’s role at MPC as Director of Historic Tax Credits/Fund Management. In this new role, Bagwell will assist in the continued development of the Historic Tax Credit Division and serve as Fund Manager of multi-investor historic tax credit funds of the Company. Bagwell has been a part of the recent growth of the division, working closely with developers in various transactions to maximize the Company’s investment fund returns. Over the past decade, Bagwell’s work in the real estate industry has provided him with extensive knowledge in working with historic and affordable housing investments in the construction, the lease-up, and the pre-conversion stages. He has also managed relationships with industry professionals and large portfolios of real estate.

“We are excited to continue our growth and development of the Historic Tax Credit Division within MPC. As a tax credit equity source for historic rehabilitation projects, we want to continue to positively impact increasing numbers of communities throughout the US. To enable that growth means building a team comprised of the best expertise in the industry,” said Rick Chukas, MPC’s Managing Director of Federal Historic Tax Credits. “With the addition of Blair Williams and the expansion of Matt Bagwell’s role, we will be able to further support our tax credit equity investments and fund investors.”

For more information about MPC or available programs and services, please contact Rick Chukas at (615) 373-5155 or rchukas@monarchprivate.com. Additional information is also available by visiting www.monarchprivate.com.

About Monarch Private Capital

Monarch Private Capital positively impacts communities by investing in tax credit supported industries. The company is a nationally recognized tax equity investor providing innovative capital solutions for affordable housing, historic rehabilitations, renewable energy, film, and other qualified projects. Monarch has long term relationships with institutional and individual investors, developers, and lenders that participate in these types of federal and state programs. Investors look to Monarch to create, operate, and manage a variety of different funds, including investment opportunities that address ESG initiatives that provide a quantifiable impact. Headquartered in Atlanta, Monarch has offices and tax credit professionals located throughout the U.S.

[1] Rutgers, National Park Service, Annual Report on the Economic Impact of the Federal Historic Tax Credit for Fiscal Year 2018, HTC cost encourages a five times greater amount of historic rehabilitation, www.nps.gov/tps/tax-incentives/taxdocs/economic-impact-2018.pdf

Related Posts

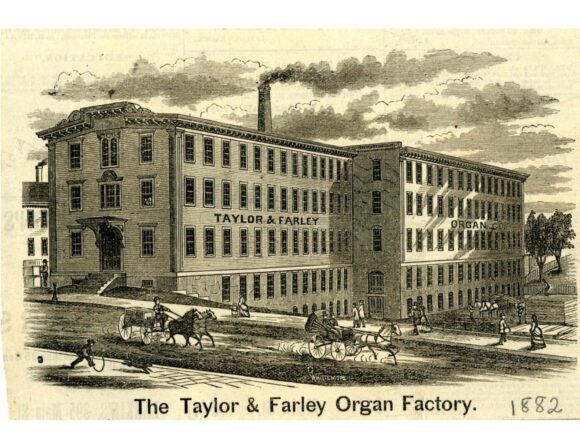

Novogradac Article: HTCs Help Compose New Song for Former Taylor and Farley Organ Factory in Worcester, Massachusetts

Jan 31, 2025

Nick Decicco, Senior Writer, Novogradac A former organ factor in Worcester, Massachusetts, with history reaching back to the mid-19th century is set for a future as 36 apartments thanks to […]

Monarch Private Capital Finances the Rehabilitation of Historic Landmark in New Orleans

Feb 26, 2024

Redevelopment of historic landmark to breathe new life into iconic Bank of New Orleans Building Monarch Private Capital, a nationally recognized impact investment firm that develops, finances, and manages a […]

Monarch Private Capital Finances Historic Rehabilitation of New York and New Jersey Telephone Exchange Building

Oct 10, 2024

$59 Million Redevelopment Will Restore Brooklyn Landmark and Offer Luxury Housing by 2026 ATLANTA (GLOBE NEWSWIRE) – Monarch Private Capital (Monarch), a nationally recognized impact investment firm that develops, finances, […]